Applying for a fee reduction

Overview

If all members of a household eligible for visiting support are exempt from the municipal tax or on public assistance, you can apply for a fee reduction.

To apply, attach the required documents according to the household classification.

<Notes>

- The usage fee reduction applies to appointments made after the date the fee reduction was approved. However, the fee reduction does not apply outside of the applicable fee reduction period.

- If you are on public assistance and your usage of public assistance is suspended, terminated, or changes or if you are exempt from the municipal tax and your tax status changes, promptly inform the Osaka City Childcare Support Helper Office.

- If you get the fee reduction without meeting the requirements, you will be required to pay the regular fee for all uses and cancellations dating back to the point in time you were no longer eligible.

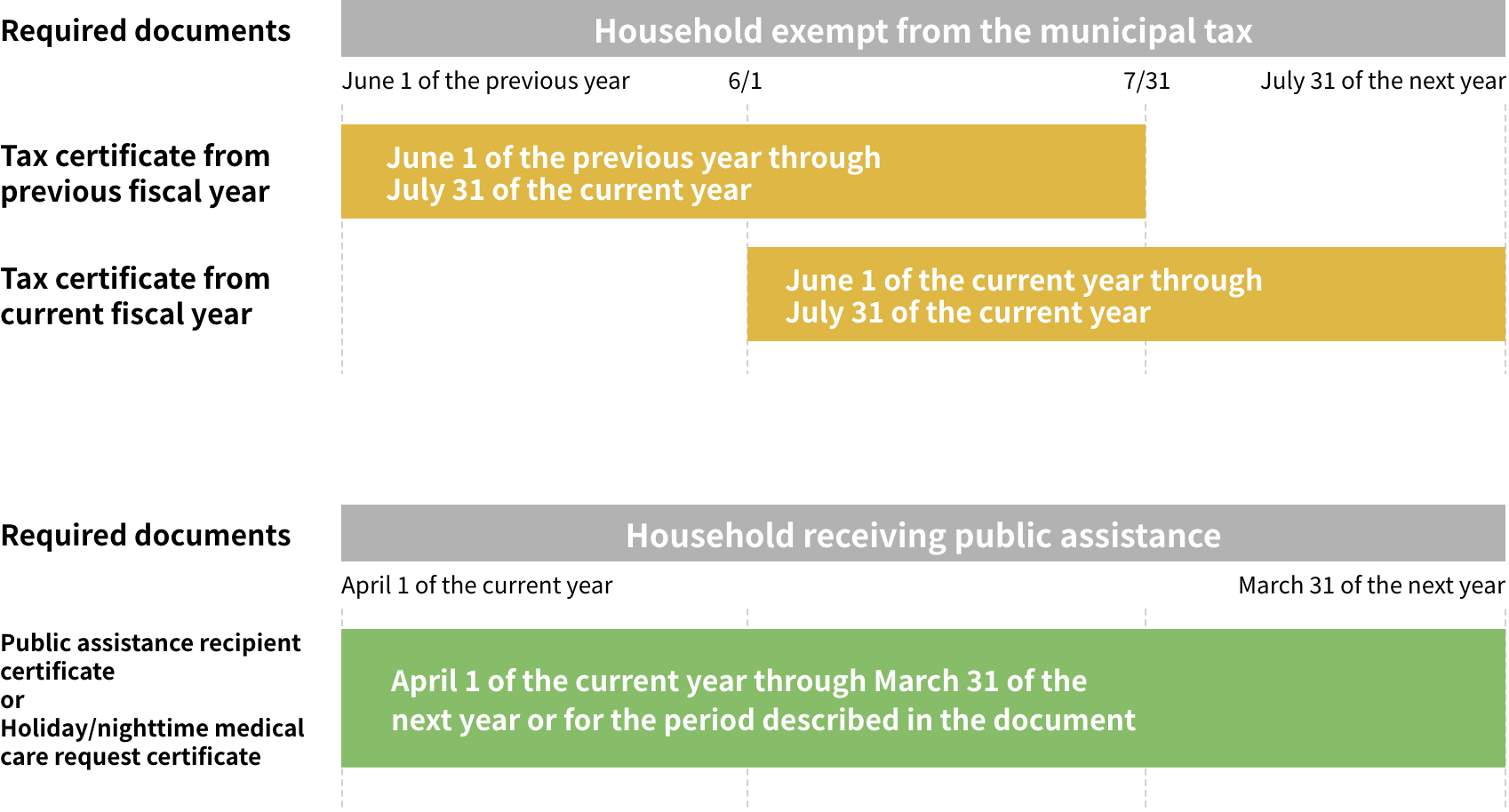

Required documents and their period of validity

| Household classification | Required documents | Applicable period of fee reduction | Notes |

|---|---|---|---|

| Household exempt from the municipal tax |

Municipal (income) tax certificate All household members with income (This includes parents with the same livelihood living separately due to work.) * Refer to <Details regarding the documents required> (1) |

June 1 of the corresponding fiscal year through July 31 of the next year | • If you submit a municipal tax certificate from fiscal 2024 ➡ The fee reduction is applicable from April through July 31, 2025. • If you submit a municipal tax certificate from fiscal 2025 (issuable from June 2, 2025) ➡ The fee reduction is applicable from June 1, 2025 through July 31, 2026. |

| Household receiving public assistance |

Public assistance recipient certificate * Refer to <Details regarding the documents required> (2) |

April 1 of the fiscal year of issuance through March 31 | • The document was issued in the fiscal year that corresponds to the usage date. (At the time of issuance, it is still valid). |

|

Holiday/nighttime medical care request certificate * Refer to <Details regarding the documents required>(3) |

April 1 of the corresponding fiscal year through March 31 | • The date of use is within the range of the validity of the request form. |

| Household classification | Household exempt from the municipal tax |

|---|---|

| Required documents |

Municipal (income) tax certificate All household members with income (This includes parents with the same livelihood living separately due to work.) * Refer to (1)

|

| Applicable period of fee reduction | June 1 of the corresponding fiscal year through July 31 of the next year |

| Notes | • If you submit a municipal tax certificate from fiscal 2024 ➡ The fee reduction is applicable from April through July 31, 2025. • If you submit a municipal tax certificate from fiscal 2025 (issuable from June 2, 2025) ➡ The fee reduction is applicable from June 1, 2025 through July 31, 2026. |

| Household classification | Household receiving public assistance | |

|---|---|---|

| Required documents |

Public assistance recipient certificate * Refer to <Details regarding the documents required> (2) |

休日・夜間等診療依頼証 * Refer to <Details regarding the documents required> (3) |

| Applicable period of fee reduction | April 1 of the fiscal year of issuance through March 31 | April 1 of the corresponding fiscal year through March 31 |

| Notes | • The document was issued in the fiscal year that corresponds to the usage date. (At the time of issuance, it is still valid). | • The date of use is within the range of the validity of the request form. |

Details regarding the documents required

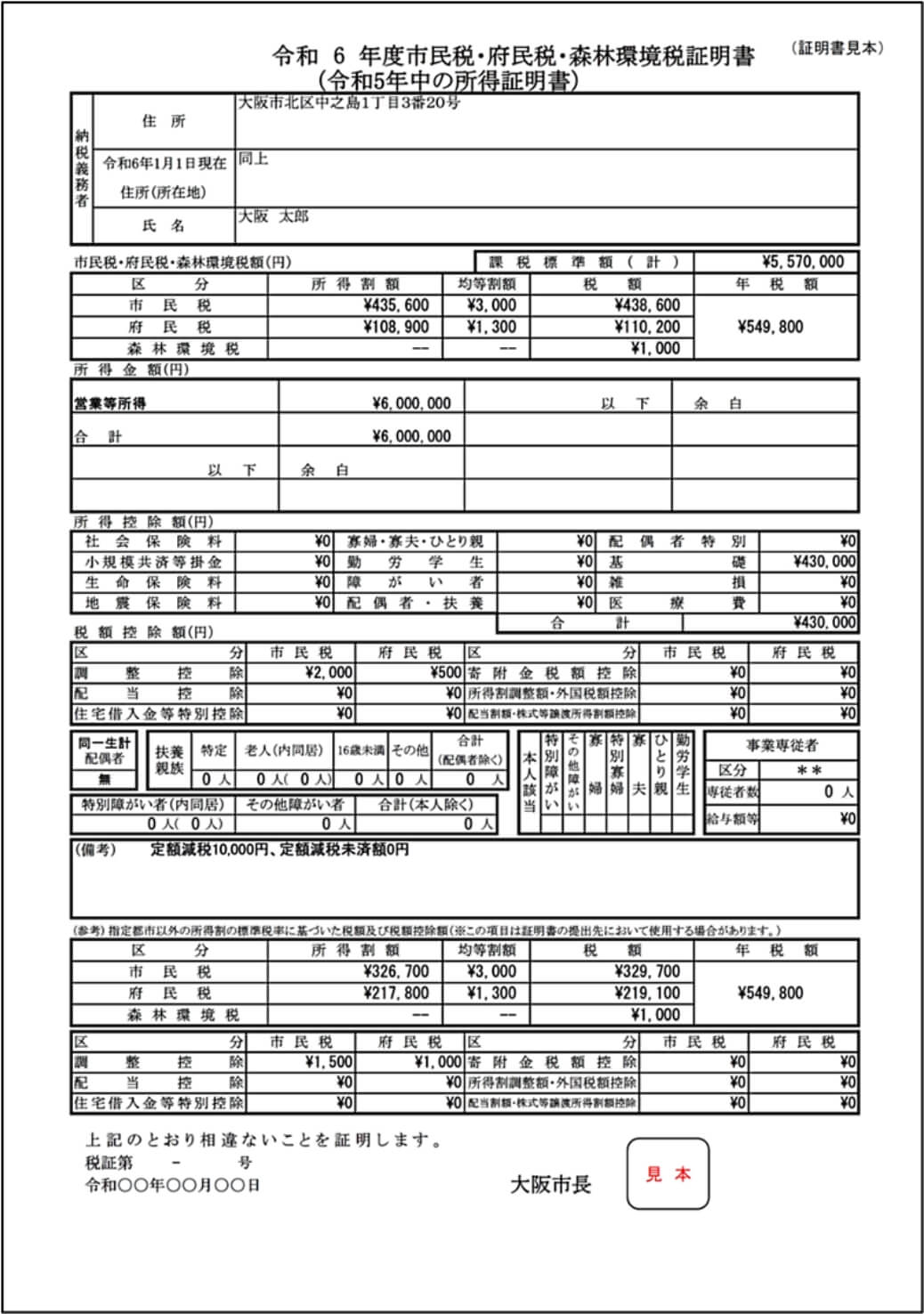

① Municipal (income) tax certificate (municipal tax, prefectural tax, forest environmental tax certificate)

■ How to obtain

- Request the certificate from the city tax office or a ward office or branch. For details, click the following link.

- This is issued by the local government of your residence as of January 1. If you moved to Osaka City, you must obtain the document from the local government of your previous residence. (Certificates from other cities are valid as long as we can confirm that you were not subject to the municipal tax.)

- Tax certificates for the current fiscal year are available from June 1 (If it falls on a Saturday, then the next business day.). (E.g.: The certificate for fiscal 2024 is available from June 1, 2024.)

■ Validity period of certificates

- Once you submit a valid certificate, you do not need to submit another certificate for usage of the service through July 31. (E.g.: If you submit a certificate in August 2024, you do not need to submit another certificate until July 31, 2025.)

- However, if you become subject to the municipal tax during the fiscal year, contact the Osaka City Childcare Support Helper Office.

■ Copies of certificates (Osaka City certificates)

②Public assistance recipient certificate

■ How to obtain

- Request your local health and welfare center to issue the public assistance recipient certificate.

- Ensure that the certificate shows the names and dates of birth of all household members.

■ Validity period of certificates

- Once you submit a valid public assistance recipient certificate, you do not need to submit another certificate for usage of the service within the same fiscal year. You will have to submit a certificate again for the following fiscal year.

③ Holiday/nighttime medical care request certificate

■ How to obtain

- This is issued by your local health and welfare center.

■ Validity period of certificates

- Once you submit a valid holiday/nighttime medical care request certificate, you do not need to submit another certificate for usage of the service within the same fiscal year. You will have to submit a certificate again for the following fiscal year.